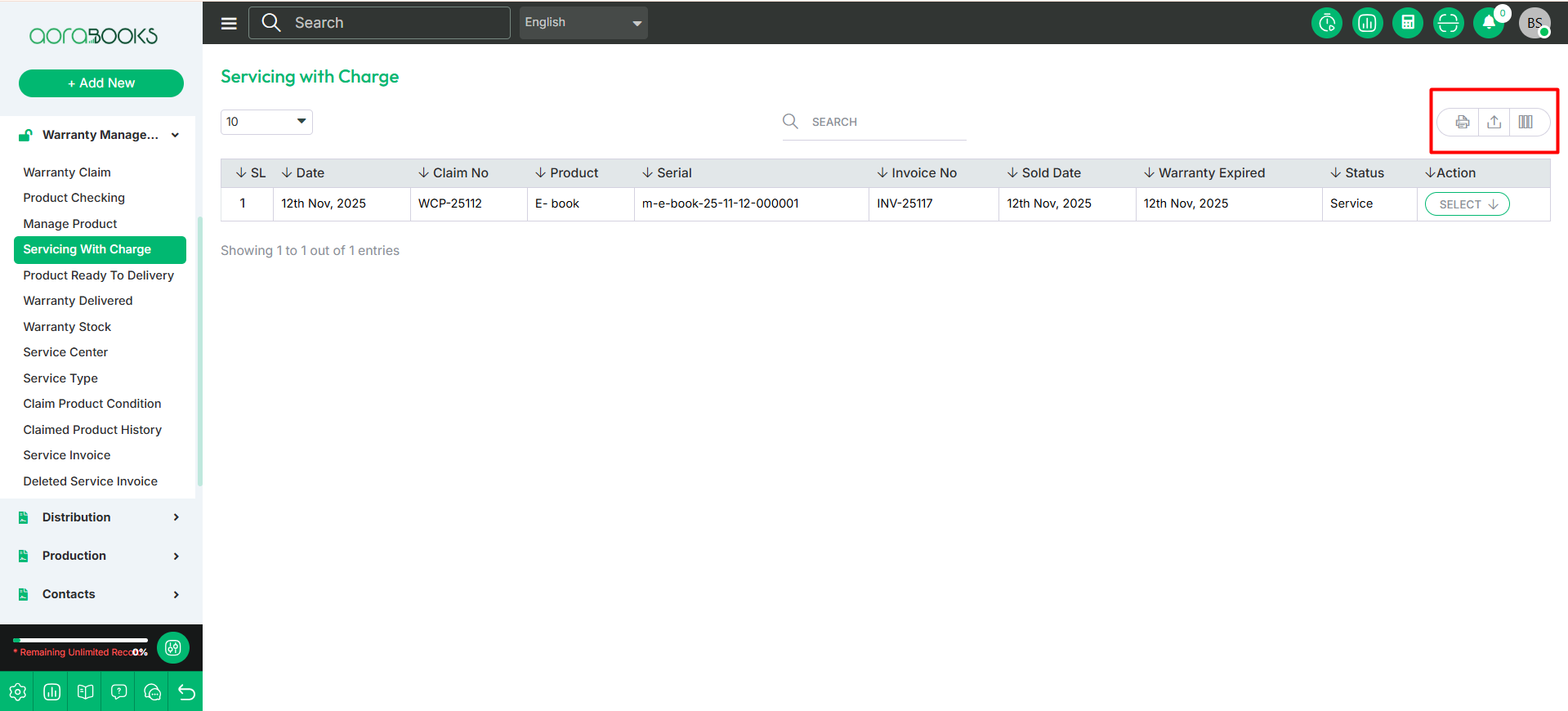

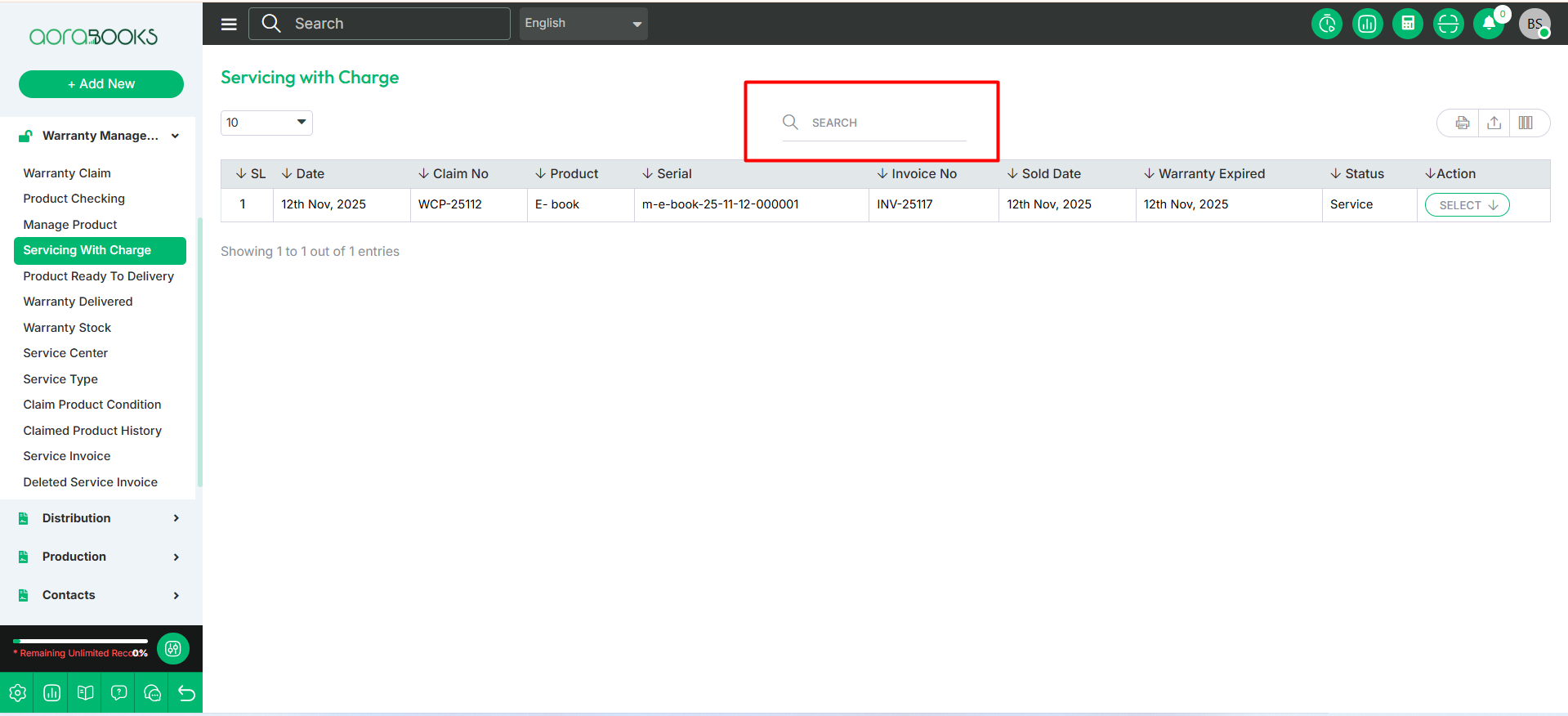

Servicing With Charge

If a product is not covered under warranty or requires repairs beyond the warranty terms, it will be listed under servicing with charge.

If any product is listed under Servicing with Charge, you can see the product here with details such as:

Date: The date when the product was listed for servicing with a charge.

Claim No: The unique identification number assigned to the warranty claim for the product.

Product Name: Name of the product which is under servicing with charge.

Serial: Serial of the product.

Invoice No: Invoice no of the product which is under servicing with charge.

Sold Date: The date on which the product was sold.

Warranty Expired: The date on which the product's warranty period ends.

Status: Current status of the product.

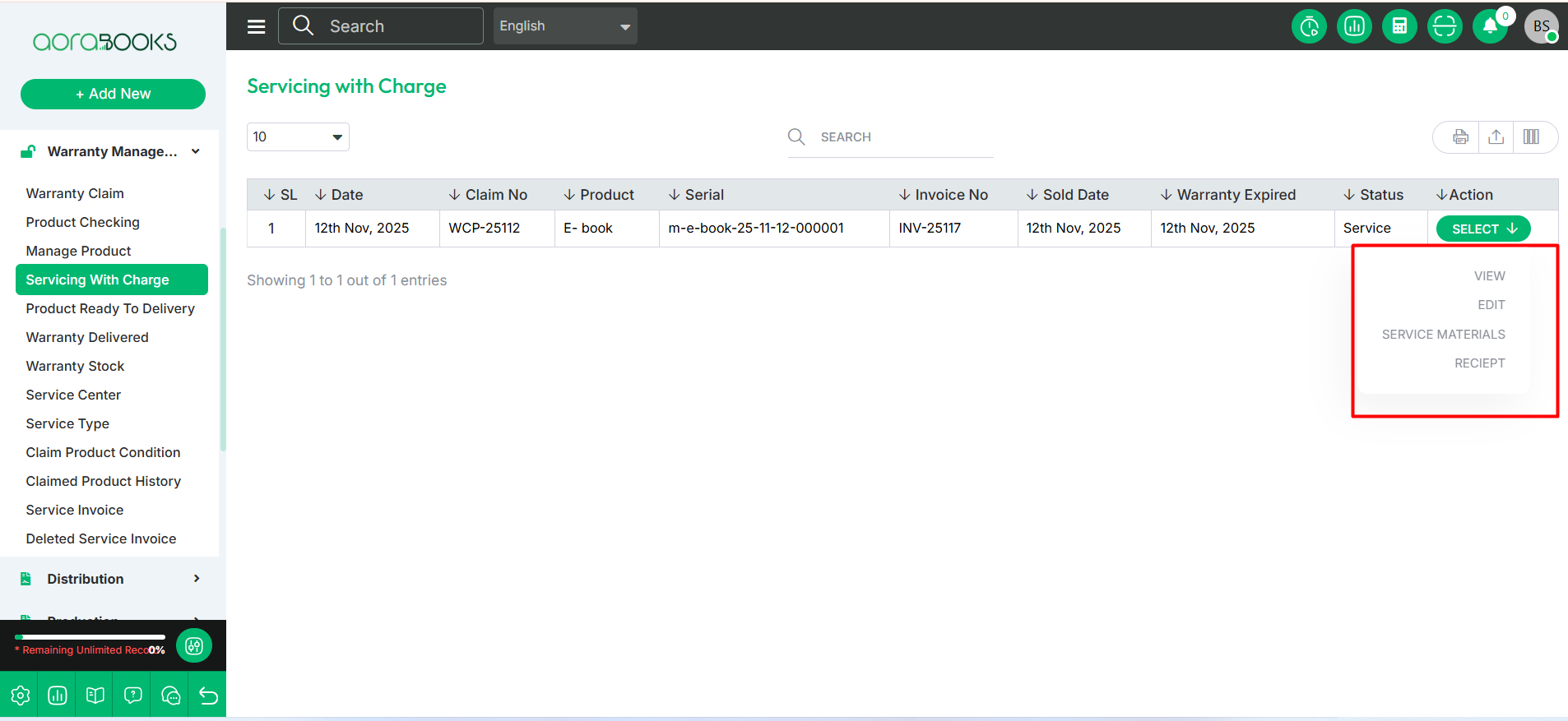

Actions: By clicking on the button you can perform multiple actions.

By clicking the select button you can perform multiple actions. Such as:

View Details: Allows you to see the complete information of the product for which you are claiming a warranty.

Edit: You can modify the details of the warranty claim if needed.

Receipt: You can view the receipt of the product associated with the warranty claim.

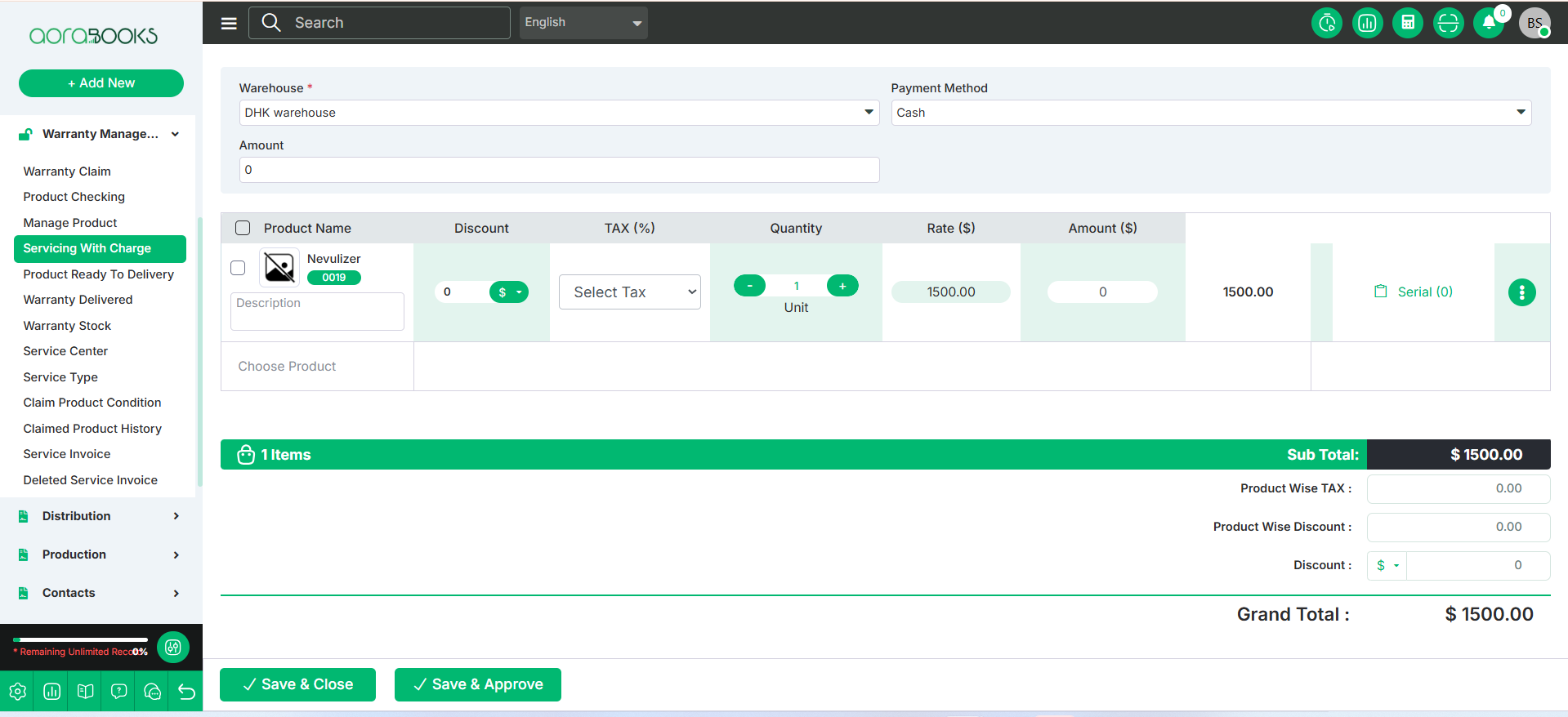

Service Materials: The list of materials or parts required for servicing the product. To set the materials you have to click on service materials button after that follow the below steps:

Warehouse: You can select the warehouse from where the service materials will be taken.

Payment Method: Choose the method by which the payment for the service materials will be made.

Amount: Enter the total amount to be paid for the service materials.

Product Name: Enter the name of the product for service materials.

Discount: Apply any discount applicable to the service materials or the servicing charge.

Tax: The percentage of the TAX on the product.

Quantity: Specify the number of service materials used for the warranty servicing.

Rate: Set the price per unit of the service material used for the warranty servicing.

Amount: The total cost is calculated based on the quantity and rate of the service material used.

Serial Key: The unique identification number assigned to the product for tracking and warranty purposes.

Subtotal: Total amount before tax, discount, or additional charges.

Product-wise Tax: The tax amount is calculated individually for each product based on its applicable tax rate.

Discount: The reduction in price applied to a specific product or the total purchase amount. It can be a percentage or a fixed amount.

Save and Close: Click this button to save the entered details and close the current window or form.

Save and Approve: Click this button to save the details and approve the action simultaneously.

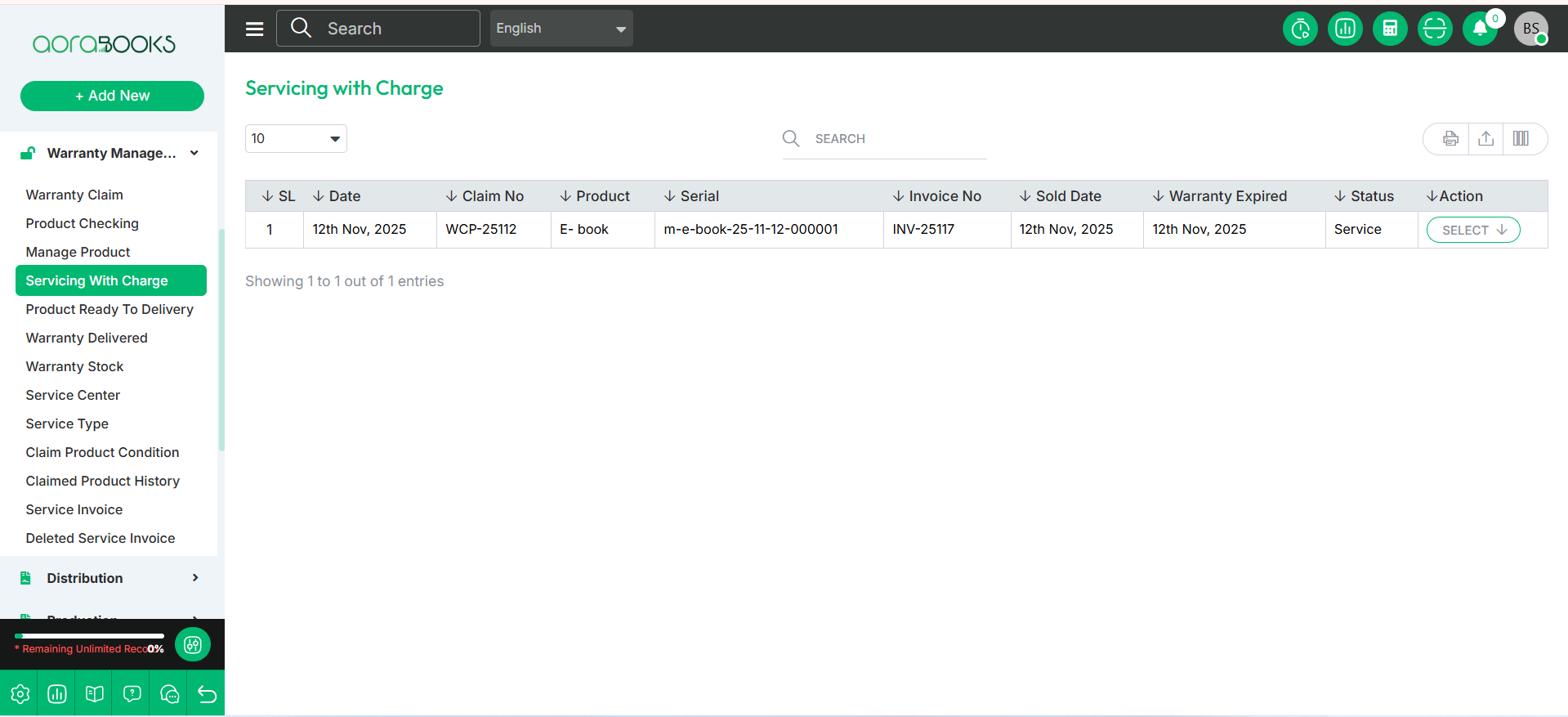

By clicking the select button, you can see the actions.

Search: You can find out any product details from the list by using the search functionality.

Export Data: You can export the data table from here.